This shop has been compensated by Collective Bias, Inc. and its advertiser, Walmart Family Mobile. All opinions are mine alone for How to have your tax refund save you money all year long. #YourTaxCash #CollectiveBias

Did you know that more than 70 percent of taxpayers receive a tax refund? And that the average is over $2,800, according to the IRS. Please note I am a blogger and brand stylist, not a CPA or an accountant. The information below is my personal experience and what has worked for my family. Today I am sharing my tips on How to have your Tax Refund Save you Money all Year Long.

Review Monthly Bills to Determine any Savings

Every year we re-access all of our re-occuring bills to determine two things: first is it a service we still need and second can we get similar service at a better value. Tax time is the ideal time to do this evaluation.

Cell Phone Plans

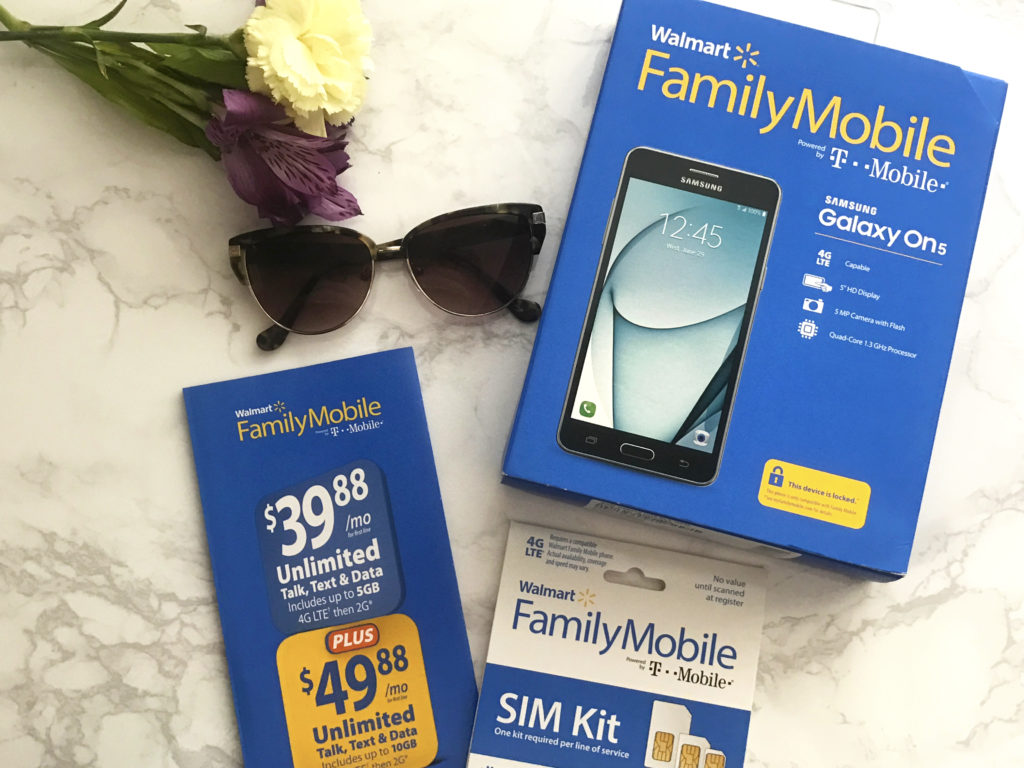

When assessing our cell phone plans I look at three different items. First phone selection. I need a phone that has a great camera and a large screen. Second start up cost including the cost of the phone to determine if it fits into our budget. Third an overview of the program including how many minutes of talk time, any limits in texting and how much data my plan will include.

First: Walmart has a great selection of phones. I selected the Samsung Galaxy On5. Regular price: $119.00. It has a 5-inch HD TFT touchscreen display. With 8GB of internal memory and a microSD card slot that's expandable up to 128GB, it's the perfect smartphone to store your whole world in music, photos, games and more.

Second: Since Family Mobile bills you later, you only have to pay $19.88 when you sign up. This combined with the low monthly rate allows you to maximize your tax refund. Just pick a phone or Bring Your Own, and get your SIM Kit for only $19.88.

Third: Walmart Family Mobile PLUS Plan = Unlimited Talk, Text, & Data which includes up to 10GB of 4G LTE then 2G. It feels like every month we use more and more data, from emails to videos to social channels. Unlimited data is extremely important to our family. My phone allows me to balance work and my personal life. As a blogger, I depend on my phone to take lots of pictures to share on social media and on my blog. Given the number of consumers on their phones I am constantly checking my blog on my phone to make sure they have a great experience. We are on our phones almost all day, I would be lost without it.

Bonus: An added benefit is the free VUDU movie credit every month ($7 value, the same as a new release rental) per line for $49.88. Allowing you to have a family movie night. We love snuggling up on the couch with snacks for family movie night. One of my favorite movie nights we even blogged about when we made echo slime popcorn to eat while watching Ghostbusters.

TV/Cable:

Two years ago we officially cut the cord and we have never looked back. I need to write a blog post about this, but we have saved thousands and thousands of dollars without sacrificing our favorite shows. There are some upfront cost in equipment so tax time is the perfect time to cut the cord.

Monthly Subscriptions:

There are so many services from music streaming to subscriptions like onstar seem like a small amount of money, but they add up over the year. This is a great time to determine if you need them.

Pay Off Any Debt

The faster that you can get to be debt free the faster you can get back to your savings goals.

Build your Emergency Fund

Did you know it is recommended to have 6 months of savings just in case of an emergency?

Contribute to Retirement or College Savings

Let your refund continue to grow tax-free or tax-deferred by putting it into a Traditional or Roth IRA or a 401K. In 2017, you can contribute up to $5,500 or up to $6,500 if you’re 50 or older. If you have already maxed out these accounts contribute part of your refund to a 529 plan that is free from federal taxes. You can contribute almost $400,000 depending on your state.

What are you doing to do if you get a tax refund?

Disclaimer: All prices for phones and plans included in this post are accurate as of the date of posting; however, these prices are subject to change. Please refer to this link or your local Walmart for current pricing.

Pin for Later:

How to Have your Tax Refund Save you Money all Year Long

Kim says

This is great! Subscriptions are probably my downfall but I just can't determine which ones to eliminate. I love them all but know they add up over the months.

Cristy says

It is so hard to eliminate them. I always try to look at the price for the year instead of the month because you are right they add up so quickly.

Stephanie says

Great idea to use extra tax cash to build an emergency fund - such a great safety net to build with your refund! #client

Cristy says

So true. Love using tax time as a time to save more money!