Sharing top ways to save money for everyone asking How can I save Money. This article includes good ways to save money this year and the top ways to save money that worked for our family. Thank you to P&G for sponsoring this post.

Last year we became completely debt free. And it come not have happened at a better time since just a couple of months after my husband's position was eliminated at his company after 14 years of service. They had been purchased by investors and we were worried it was going to happen. We learned so much during this process I am so excited to share with you.

Everyday Bills

The New Year is a great time to look at all your everyday bills and update your monthly budget. I recommend the process of how can I save money with your everyday bills.

Do you have subscriptions or memberships you no longer need or use? When I did this last I realized there were memberships and subscriptions that automatically renewed, and I did not even realize I was still paying for. Talk about a waste of money. Even for memberships you still use check to see if they offer less expensive packages that may still fit for your needs. Many companies offer free versions that may meet your needs.

Next review your everyday bills like cable, internet, insurance, credit cards, etc. Do you have the best package for your needs for all these items? New packages come out all the time. Make sure you are calling every 6 months to ensure you have the best value. Kurt even sets a reminder on his phone to call our internet provider because they release new packages all the time.

Did you know that many electric companies will give you a free energy survey? They give you great tips for ways to reduce your energy expenses. Some tips we got included:

- Switch light bulbs to LEDs

- Turn off ceiling fans when you are not in the room

- Program your AC to be warmer when you are not home

- Upgrade appliances to energy saving appliances

Everyday Products

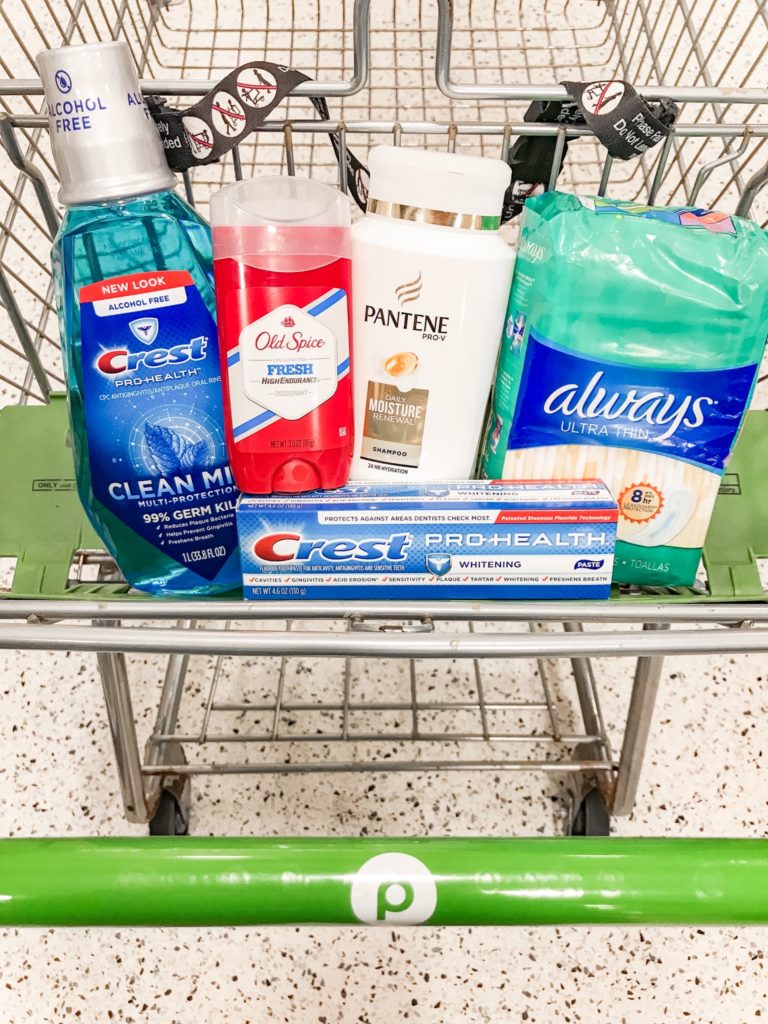

My husband loves a good deal because it is an easy way to save money. The best way to save on everyday products you love is to look for promotions and then stock up on items I know I will use before they expire. Worried about storing these products check out my post on how to organize your linen closet.

For example, now is a great time to save on Healthy and Beauty items at Publix. In addition to these great deals on P&G products and Publix are also rewarding you with a Gift Card. All you need to do is buy $15 worth of P&G products and you will get $5 Publix Gift Card. This promotion runs from January 23rd to January 29, 2020.

Teeth

2 for $6

- Crest 3D White Toothpaste or Pro-Health (3.0 to 4.6oz. box)

- Complete (4.6 to 5.4oz.)

- Crest (2 x 5.7oz. box)

2 for $10

- Crest Pro-Health Mouthwash 1-L bottle.

Hair Care

2 for $12

- Pantene Hair Care Products (24-25.4oz. bottle)

- Head & Shoulders (10.6-13.5oz. bottle)

- Hair Food Care (10.1oz. bottle)

2 for $8

- Herbal Essences (11.7oz. bottle)

- Old Spice (12oz. bottle)

- Deodorant & Body Wash

2 for $10

- Secret Aluminum Free Deodorant

- Outlast or Fresh (2.4 – 2.6oz pkg.)

- Old Spice Fresh, Wild or Red Collection (2.6 or 3oz. pkg)

- Gillette (3.8oz.pkg)

Body

2 for $12

- Olay Body Wash (18 or 22oz. pkg. or 6 bar soap)

- Feminine Care

Feminine Products

$6.99

- Tampax Pearl Tampons (28 to 26ct.)

- Radiant Tampons (28 to 26ct.)

- Always Infinity, Radiant, Ultra-Thin or Maxi Pads (18 to 46ct.)

Entertainment Costs

A great way to decrease your entertainment costs is to look for free or low cost events. If you live in South Florida, the City of Boca hosts lots of free events. Both Modern Boca Mom and Local Mom Scoop do a weekly roundup that has great information on both free and low cost event as well as events with tickets.

Dining Out

When we first took a deep dive into our monthly budget I was shocked how much we spent eating out. We quickly realized that eating out was a huge budget killer for us. So, now we like to save our eating out budget for social occasions.

And we look for deals at our favorite local restaurants. Did you know that happy hours often include food? Plan your eating out around deal like that or things like kids eat free. To do this we have found the best way to stick to our eating at home goal is to Meal Plan. Learn how you can do weekly meal planning as well.

Instead of eating out for lunch every day we pack a lunch. We also avoid buying things like coffee and paying for valet parking. Those little leaks of $5-10 can add up to hundreds or thousands of dollars for our daily habits.

Avoid Interest Payments

The hardest cycle to break is the ease of financing. In America we live in an overly financed country. You can finance everything from cell phones to furniture. For example, we bought both of our cars with 0% interest which meant that every dollar we paid went straight to the principal and now they are fully paid off. I could write a whole post on credit cards, but I will just leave it at this, credit card debt is a terrible cycle and once you get sucked into it is very difficult to find a way out.

Big Purchases

Plan out big purchases and give yourself a cooling off period before making any large purchases. Kurt and I set a threshold were we do not make purchases above without talking about it. It has saved us hundreds of dollars. We have also found that Black Friday is the best time to find a deal on big purchases from electronics to furniture.

Pin for Later: Good Ways to Save Money

Leave a Reply